Shakedown or smart business? Quebec restaurants balk at hefty penalty for using competitor's payment machines

In the restaurant industry, stability is critical.

So when David Ferguson noticed an unexpected $200 charge on his credit card bill from the tech company he uses to help manage his business, he figured it was an accounting mistake.

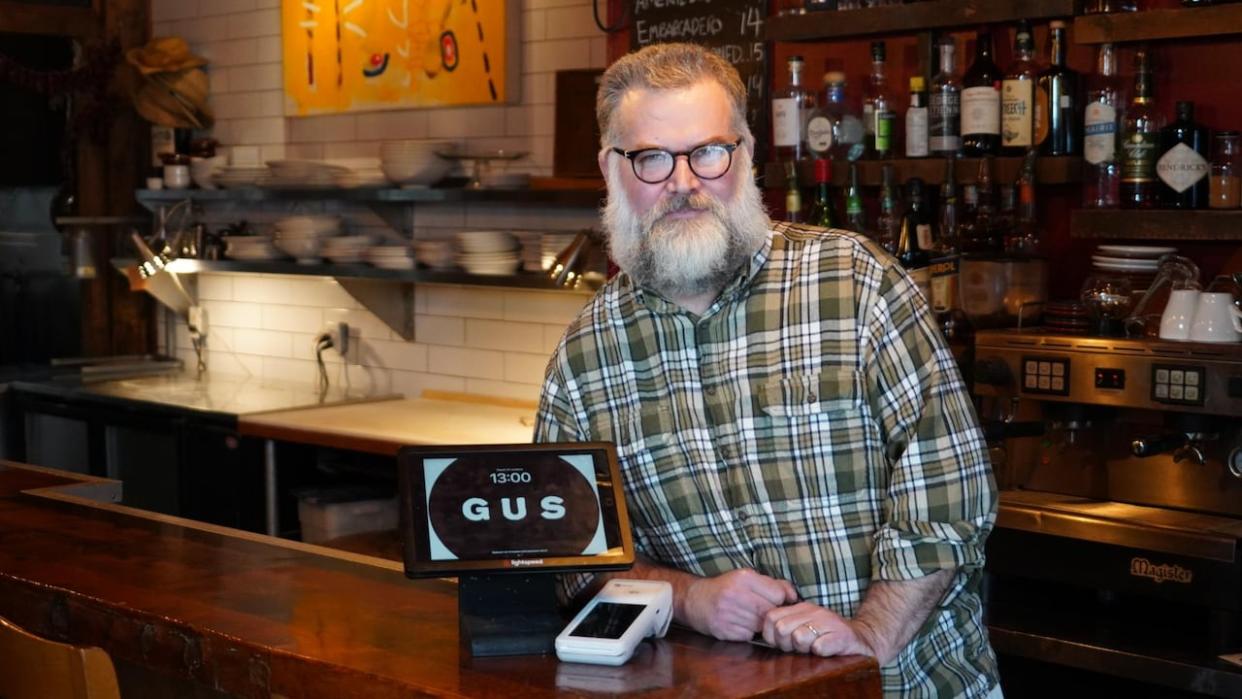

Ferguson is the chef and owner at Gus, a small restaurant in Montreal's Petite-Patrie neighbourhood.

He started using Lightspeed, a publicly traded Canadian point-of-sale (POS) supplier, about four years ago. It provides services to thousands of restaurants and retailers across Canada.

Ferguson describes the company's cloud-based software platform as the "central nervous system" of his restaurant. It helps him keep track of his inventory and staffing. It also produces customer's bills and sends sales data to Revenu Quebec.

Lightspeed offers a point-of-sale software platform that helps restaurants manage their businesses. It now wants clients to use its payment software or pay a monthly transaction fee. (Dave St-Amant/CBC)

But when he inquired about the credit card charge, Ferguson said a Lightspeed sales representative told him it was because he was using a competitor's handheld terminal for credit card processing. Lightspeed integrated its POS hardware with its own payment platform earlier this year.

"I was like, 'What? You took $200 from me because I didn't take your product?'" said Ferguson. "I felt like it was a shakedown."

Freedom to choose at risk

The Quebec Restaurant Association said it has heard similar complaints from other upset restaurant owners.

"It's not illegal, but it's unethical," said Martin Vézina, a spokesperson for the association.

In the spring, the company told its POS customers by email that if they did not adopt Lightspeed Payments as well, it would charge them a transaction fee to "cover the complexity and additional costs" associated with maintaining a 'third-party provider.'

The restaurants who contacted the restaurant association were being charged a $300 transaction fee for using a competitor's payment terminal, said Vézina.

With Lightspeed forcing customers to take its product, the association is afraid people will be locked into contracts that aren't competitive which could result in higher fees. It is also concerned other POS suppliers may follow Lightspeed's lead.

"Let owners choose what solution is the best for them," said Vézina.

The association suspects Lightspeed started pushing its own payment software because it sensed a revenue opportunity. Most customers pay their restaurant bill with a credit card and each time one is swiped, the payment processor gets a certain percentage, said Vézina.

Martin Vézina is a spokesperson for the Quebec Restaurant Association. He says Lightspeed's business practices limits the choice of owners to decide what is best for them. (Dave St-Amant/CBC)

Although a restaurant could ditch Lightspeed and find a new POS system, it can be a hassle.

Ferguson estimates it would cost him about $2,000 to change companies and train his staff on how to use a new system, which would be extremely disruptive. He thinks Lightspeed is banking on that.

"We are working in such a high-pace industry and muscle memory is king," said Ferguson. "Changing anything, even the organization of the plates, sometimes can screw people up."

The $200-charge showed up in Ferguson's September statement. Lightspeed suspended the fee this month and told Ferguson it would work with him to find a solution, but he has not heard back.

For his restaurant, he says $200 a month is equivalent to a cook's salary for a day and over a year, $2,400 is close to what he pays in business taxes.

In a climate where many businesses are repaying pandemic loans and struggling with increased labour and food costs, Lightspeed's decision hurts.

"It feels like a bit of [a] violation," said Ferguson. "I am working with a supplier who feels it's entitled to take my money. "

I am working with a supplier who feels it's entitled to take my money. - David Ferguson, chef and owner at Gus

Competition reform?

Unlike consumers, small businesses have little protection, said Jennifer Quaid, a competition law expert.

In this case, Quaid, a law professor at the University of Ottawa, says it appears Lightspeed may be trying to leverage its position as a larger player to strong-arm customers into using both its software and hardware.

Last month, the federal government announced it intends to update Canada's competition laws.

Lightspeed is a publicly traded company in Montreal that specializes in point of sale (POS). Earlier this year, it integrated its POS and payments platform into one package. (Lightspeed web site)

That could be an opening to take a closer look at cases like this, said Quaid.

There has been talk about the power digital giants have, but intermediaries — companies with enough market share to act with some or complete independence from market discipline — should be considered.

"Are they in a position where they actually control access to the market, where if you don't play with them, you don't get access to the market at all?" she said.

The Quebec Restaurant Association is also exploring its options and is working on a partnership with a POS supplier. If they come to an agreement, the company would offer the association's members a discount on subscription fees and allow restaurant owners to choose their own payment-solution supplier, said Vézina.

Company says benefits outweigh inconvenience

Lightspeed said it recognizes it is asking customers to make a change but is confident that consolidating payments with its POS software will be beneficial for merchants and their customers, said Lightspeed president JD Saint-Martin.

A unified software package can help businesses save time on bookkeeping, generate more revenue and reduce the risk of fraud, said Saint-Martin.

Lightspeed said while switching payment companies may be a short term inconvenience, it believes customers will see the benefits in the long term. (Khaled Yeddes/CBC)

To make it easier for businesses to switch, Lightspeed offers free payment terminals, contract buyouts to cover early termination fees, competitive processing rates and free on-site installation.

But if merchants still aren't persuaded, businesses will be charged a transaction fee of approximately 0.5 per cent of a merchant's monthly gross transaction volume.

"On our side, there are significant costs that we incur by having to manage third-party processing," said Saint-Martin.

Ferguson thinks the company anticipated some blowback but is ultimately more concerned about its bottom line and getting a return for investors.

He resents having the threat of another $200 being charged to his credit card every month.

"That's not the type of incentive that makes me want to work with them," said Ferguson.