Even as the demand for affordable housing continues, the federal government is taking steps to curb inflation by raising interest rates by three-quarters of a percentage point. This relatively small hike will allow the government to assess the impact and make more informed decisions about additional increases that could happen in 2022. This latest increase has some development companies re-examining their project schedule, but ultimately, the multi-family housing market isn’t expected to slow down.

Fact #1

Rent Rates Stay Strong

Despite this latest hike in rates, interest rates still remain at a historic low overall, which is expected to continue to spur growth. Experts at the National Apartment Association are predicting that rent rates will stay strong and even reach record-breaking levels, which means that the demand for commercial multifamily lending will also keep steady.

The pandemic certainly highlighted the need for affordable housing and investors and lenders have been leading the charge to find solutions. While the government has been working on various programs and initiatives that would address the shortage, bureaucracy moves slowly and the U.S. is still about 7 million short of rental homes.

Download the Infographic

Download a detailed walk-through with this Infographic, showing other areas of growth within CRE multifamily housing to potentially offset interest rate increases.

Affordable Housing Demand Ensures Growth

This has created a situation where commercial lenders and builders have recognized both the opportunity for innovation and the fact that affordable housing can help them meet their corporate missions and financial goals. The private sector has answered the demand for housing with innovative new technology, strategic partnerships, and non-traditional housing solutions. As a result of these new approaches to lending and development, the CRE multifamily sector has created tremendous momentum that won’t be slowed by interest rate hikes.

Fact #2

Workforce Apartment Communities Attract Strong Demand in 2022

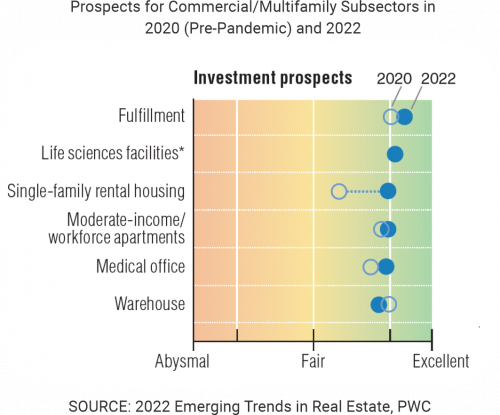

According to the “Emerging Trends in Real Estate” survey, workforce housing is on track to be one of the most performant prospects for investors. As you can see in the graphic below, workforce housing is and will continue to rate as an ‘excellent’ prospect in the years to come.

Fact #3

Impressive Workforce Housing

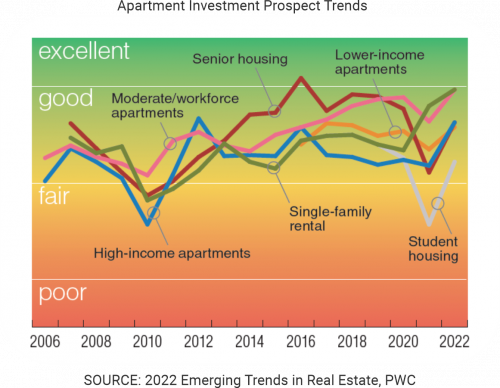

Performance Since 2010

The performance of workforce housing has been no less impressive when viewed historically since the Great Recession, consistently tracking higher than low- and high-income apartments and single-family rentals.

Fact #4

Repurposing Vacant Office Space for Workforce Housing

One interesting category folded into the larger category of workforce housing? Vacant office space that has been repurposed for workforce housing. According to Yardi Matrix, 41 percent of the 32,000 legacy buildings that were renovated into residential spaces between 2020 and 2022 were originally office spaces. With office vacancies spiking by over 12 percent in the start of 2022, this subcategory may offer even more opportunities and sustain the momentum of workforce housing moving forward.

A Digital Transformation Case Study

Leveraging digital lending technologies to accelerate growth and leapfrog the competition in the private lending market.

Fact #5

Top-Performing Lenders Experience Growth

The health of the multifamily housing market is certainly reflected in the lending space, as well. Top-performing lenders are reporting sustained growth in multifamily lending.

“Any changes in the market tend to cause a level of uncertainty, but our top-performing multifamily lenders have been experiencing YTD growth rates of 60%. Looking forward to the rest of 2022, we expect all of our 1-4 unit multifamily lenders to experience growth of over 50%."

Steve Butler, CEO, GoDocs Tweet

Fact #6

Bridge Loans are Effective at Times Like This

Those who want to take advantage of the wealth of opportunity in this space can benefit from considering bridge loans. These products are an ideal answer for financing rehabs on existing real estate, such as retail or office spaces that can be converted into affordable or workforce housing rentals. A bridge loan serves as a short-term real estate financing solution, providing an influx of cash for borrowers seeking to sell newly-rehabilitated income-producing properties. With bridge loans, developers can get units rented expeditiously to enjoy a greater return by benefiting from the higher rents happening now — even in affordable housing scenarios.

Fact #7

Digital Technology Balancing Act

Any slowdown in the multifamily sector is simply a natural balancing out after such a record-breaking 2021. While increasing interest rates are bound to have some effect on lending practices and development across all real estate sectors, multifamily lending and development will remain strong for the rest of 2022, and GoDocs users will be able to handle significantly higher loan volume and keep pace with demand.

Automation Versus Legacy Attorney Process for Closing Docs

Making the transition to digital technology is not just about ease of use. Leveraging solutions such as GoDocs to execute closing docs ameliorates several pain points that have historically plagued the legacy attorney process. The automation inherent in such solutions offers a much faster and more efficient process, for one, ensuring that developers can spend less time and money on this essential end step in the cycle. Utilizing automation for loan processing and closing can translate into an estimated 78% reduction in attorney closing cost when compared to the legacy approach.

Digitization also addresses the issue of human error— even the most skilled attorney can make a mistake, and small mistakes can cost developers big when large-scale projects are on the line. A digital solution is always consistent. By investing in solutions such as GoDocs, investors and developers can experience greater ROI as they take advantage of the sustained multifamily market.

Schedule a custom demo to learn more about GoDocs’ digital solution for commercial loans, including Bridge Loans.