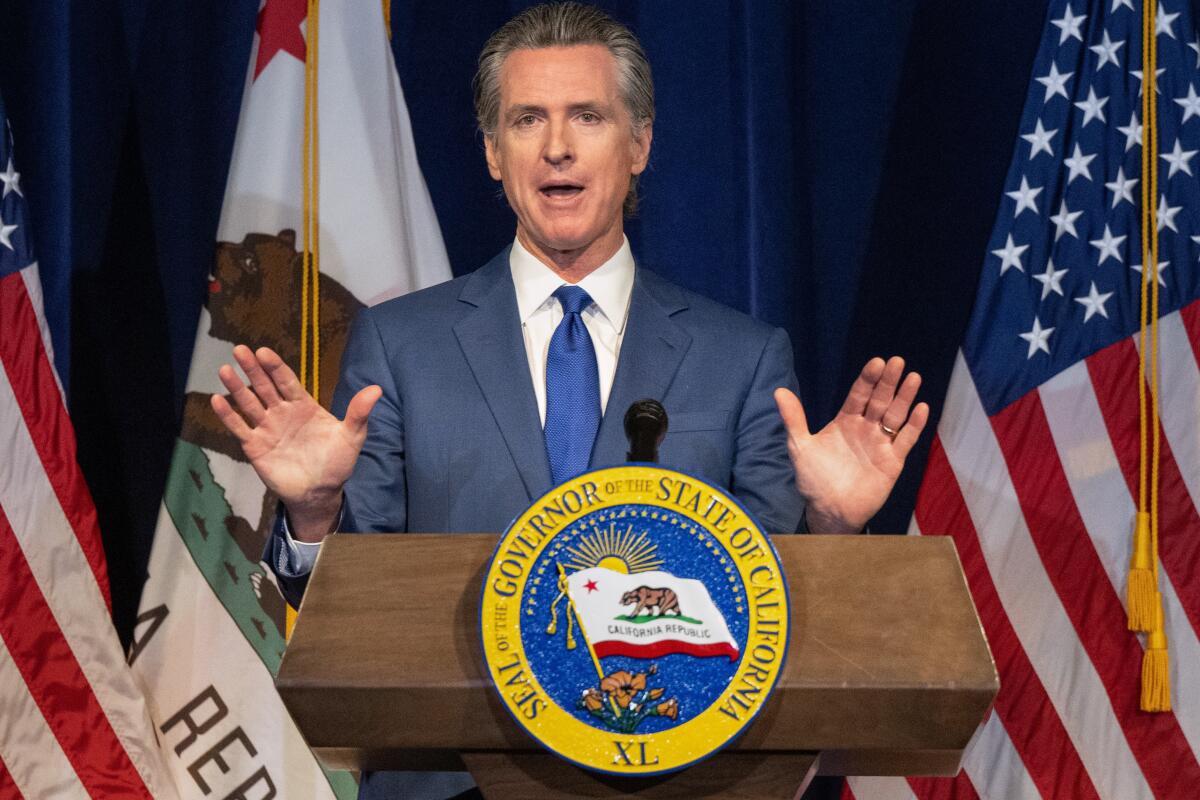

What you need to know about Newsom’s plan to offset California’s $31.5-billion deficit

California’s estimated $31.5-billion budget deficit is forcing Gov. Gavin Newsom to begin reining in his progressive policy agenda, in a stark change from the surpluses that graced his first years in office.

The governor’s $306.5-billion budget plan, which he detailed Friday when announcing his revised spending proposal, relies on money raised from bonds, taps into $450 million from the state’s safety-net reserve and renews a tax on managed care programs to support Medi-Cal while continuing plans to curtail increases for climate and transportation programs.

With tax collection expected to fall short of the money allocated for programs essential to millions of Californians, Newsom is taking a more conservative spending approach while trying to protect his marquee programs. The shortfall projections indicate that the abundance of Newsom’s first term is over, and the need to downshift in his second term could have implications for Democrats in the state Legislature and his own political legacy.

“This was not an easy budget, but I hope you see we tried to do our best to hold the line and take care of the most vulnerable, most needy, but still maintain prudence,” Newsom said.

As anticipated, the state’s budget hole deepened from the estimated $22.5-billion shortfall announced in January and marks a dramatic turn from last summer, when Newsom touted a $100-billion surplus.

Newsom and Democrats anticipated a budget deficit and were careful in prior years to mostly avoid establishing costly long-term programs, instead budgeting most of the surplus revenue to one-time funding allocations.

The governor’s proposal largely calls for the state to pare back funding increases.

A governor’s revised May budget proposal traditionally serves as a catalyst for more intense spending negotiations with the Legislature. Democrats at the state Capitol agree on many major policy priorities, but differences have emerged between how Newsom and lawmakers want to close the budget gap, with funding for child care and transportation shaping up as major areas of disagreement.

The state will shoulder the $17 million needed to raise the 14.5-mile Corcoran levee an additional four feet, protecting the city from rising floodwaters.

Why are budget projections so uncertain this year?

The federal and state governments extended tax-filing deadlines this year from April to October for most Californians, delaying the state’s ability to get a more concrete picture of its revenue until this fall. In California, about 99% of taxpayers are permitted to file late without consequence. Newsom said the state anticipates that delayed income and corporate tax receipts will total around $42 billion.

Adding to the uncertainty: The federal government is on the brink of defaulting on its debt.

With California’s finances running into the red, will Gov. Gavin Newsom scale back or delay the rollout of his progressive agenda?

How did the state swing so drastically from having too much money to too little?

The state budget is highly dependent on income taxes paid by its highest earners and is therefore subject to the ebbs and flows of capital gains from investments, bonuses to executives and tax windfalls from new stock offerings.

Chris Thornberg, an economist and founder of Beacon Economics in Los Angeles, said the shortfall was predictable and of politicians’ own making. Federal COVID-19 stimulus funding artificially boosted state income taxes higher than ever before, resulting in the record surplus. And what goes up must come down, he said.

“If capital markets went up at a nice, even pace on a year-to-year basis, this wouldn’t happen, but they don’t,” Thornberg said. “They go surging up and then go collapsing back.”

Newsom has repeatedly emphasized his decision to restrict most new spending to one-time funds, a strategy that avoids creating new, permanent demands on the state budget if revenue drops.

But even temporary programs can be costly. The governor and lawmakers provided $9.2 billion in gas rebates to 32 million Californians since approving the payments in a budget deal last June. Newsom’s revised budget proposal recoups $200 million in unallocated gas refunds to help balance the budget.

Republican leaders in Sacramento put the blame for the deficit squarely on Newsom and his fellow Democrats.

“Warnings of the governor’s unsustainable budget path are now colliding with economic reality,” said Assemblyman Vince Fong (R-Bakersfield), vice chair of the Assembly Budget Committee, in a statement. “The fact that the governor continues to overspend creating structural deficits in future years is fiscally irresponsible.”

Gov. Gavin Newsom and leaders of the California Legislature have agreed to provide more than $9 billion in refunds to taxpayers to offset high gas prices and inflation. The deal comes after months of slow negotiations at the state Capitol and disagreement between Democrats over how much relief to offer.

How will public education be affected?

For the K-12 public education system, the governor’s proposal would maintain ongoing spending, with increases in certain areas — including more than $300 million for this year and next to fulfill the state’s commitment to providing two free meals a day to all students who are not covered by federal dollars. Newsom also maintained ongoing major initiatives; notably, the gradual expansion of public education to all 4-year-olds.

But the proposal includes more than $3 billion in cuts to one-time grant programs. Some school systems had already included that funding in their budgets for next year, said Troy Flint, chief information officer for the California School Boards Assn.

In higher education, officials with the University of California and California State University were relieved that Newsom preserved a 5% increase in base funding pledged in January as part of a five-year agreement with both systems. The revised budget also includes good news for community colleges, which will receive $545 million in grants for affordable student housing over the next two years.

Gov. Gavin Newsom plans to deal with a projected $22.5-billion state budget deficit by reducing investments in climate change programs.

How does the proposal affect California’s efforts to fight climate change?

Prior budgets allocated $54 billion over five years to Newsom’s initiatives to combat climate change, and his revised budget lowers that amount to $48 billion. The decrease reflects reduced investments in the state’s effort to switch to zero-emission vehicles and expand clean transportation infrastructure.

The governor also wants to shift another $1.1 billion in funding for climate programs from the general fund to a bond measure, which he will ask the Legislature to approve in the coming months and would go to voters for final approval.

Brandon Dawson, director of Sierra Club California, criticized the governor’s plan for not restoring funding for “equitable building decarbonization, rooftop solar and coastal resilience” and for relying on “an unreliable climate bond to fill the additional funding gaps.”

What does the deficit mean for funding to address homelessness?

Newsom said he wouldn’t trim any funding from the $15.3 billion set aside since the start of the pandemic to fight the state’s worsening homelessness crisis.

“We’re not backing away at all,” he said, adding that $750 million would be used to “address the issue of cleaning up these damn encampments.”

Newsom also said he was fully committed to the sweeping mental health reforms and the behavioral health bond he outlined during his State of the State tour in March. The bond measure, slated for the 2024 ballot, could raise at least $3 billion for the construction of mental health campuses, residential settings and permanent supportive housing.

After criticizing all local homelessness plans last year, Newsom announced during his State of the State tour that locals have agreed to reduce unsheltered homelessness by 15% in two years.

Will healthcare services take a hit?

Overall, the budget increases Medi-Cal funding from the general fund by $6.7 billion compared with the current fiscal year, largely by relying on the Legislature to renew a tax on healthcare companies known as the Managed Care Organization, or MCO, tax.

Newsom proposes renewing the MCO tax to generate $19.4 billion through the end of 2026 to increase Medi-Cal reimbursements for primary care, obstetric care and non-specialty mental health services and to make Medi-Cal insurance available to all low-income people, regardless of citizenship status, as the state pledged last year. The rollout of coverage for noncitizens ages 26 through 49 is slated to begin Jan. 1.

What’s the status of child care?

Newsom’s proposal provides $6.6 billion for child-care programs but does not include long-term increases for provider pay — a priority of Democratic Legislative leaders who say improving rates will benefit children and a workforce that is predominantly women of color.

Newsom’s revision includes an 8% cost-of-living adjustment as providers struggle with rising operating costs and allows for more temporary stipends for those offering state-subsidized child care.

But Child Care Providers United, the union representing more than 40,000 workers, criticized the governor for not doing more to support “the providers upon whom our economy relies” as they struggle in negotiations over pay with the Newsom administration.

“The administration’s posture is in sharp contrast to both houses of the Legislature, which recognize the essential value of child care providers and prioritized child care in their budget proposals,” Charlotte Neal, a member of CCPU, said in a statement.

Newsom said that while California has “done more than any other state” on child care, “we have a lot of work to implement and apply.”

Was anything restored that was previously cut?

Some cuts and delays that Newsom proposed in his January budget were revived:

A program that appoints volunteers to help foster youth navigate the child welfare system saw a two-thirds funding decrease in January — a move Newsom representatives said was necessary to close the projected budget shortfall.

A first-in-the-nation plan to extend food benefits to some immigrants living in the U.S. illegally will now be available in 2025. Newsom was criticized in January when he announced that implementation would be delayed until 2027.

What’s next?

Lots of negotiation. Lawmakers have until June 15 to pass a budget for the next fiscal year, and legislative leaders indicated Friday that they’re not pleased with Newsom’s proposals for child care and transportation funding.

“Public transit is the vanguard of California’s fight against climate change, and it will be important to restore the transit capital funding the Governor and Legislature approved last year,” Assembly Speaker Anthony Rendon (D-Lakewood) said in a statement, adding that improving child-care rates is also a priority. Rendon has suggested that the state dip into its rainy-day fund.

Senate Democrats previously proposed offsetting the budget shortfall by increasing taxes on the state’s largest corporations and deferring an existing tax credit for companies that post a net operating loss to generate about $6 billion a year.

Newsom responded to both with a hard no.

Staff writers Hannah Wiley, Mackenzie Mays, Howard Blume, Debbie Truong and Teresa Watanabe and Sacramento Bureau Chief Laurel Rosenhall contributed to this report.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.